Memuat...

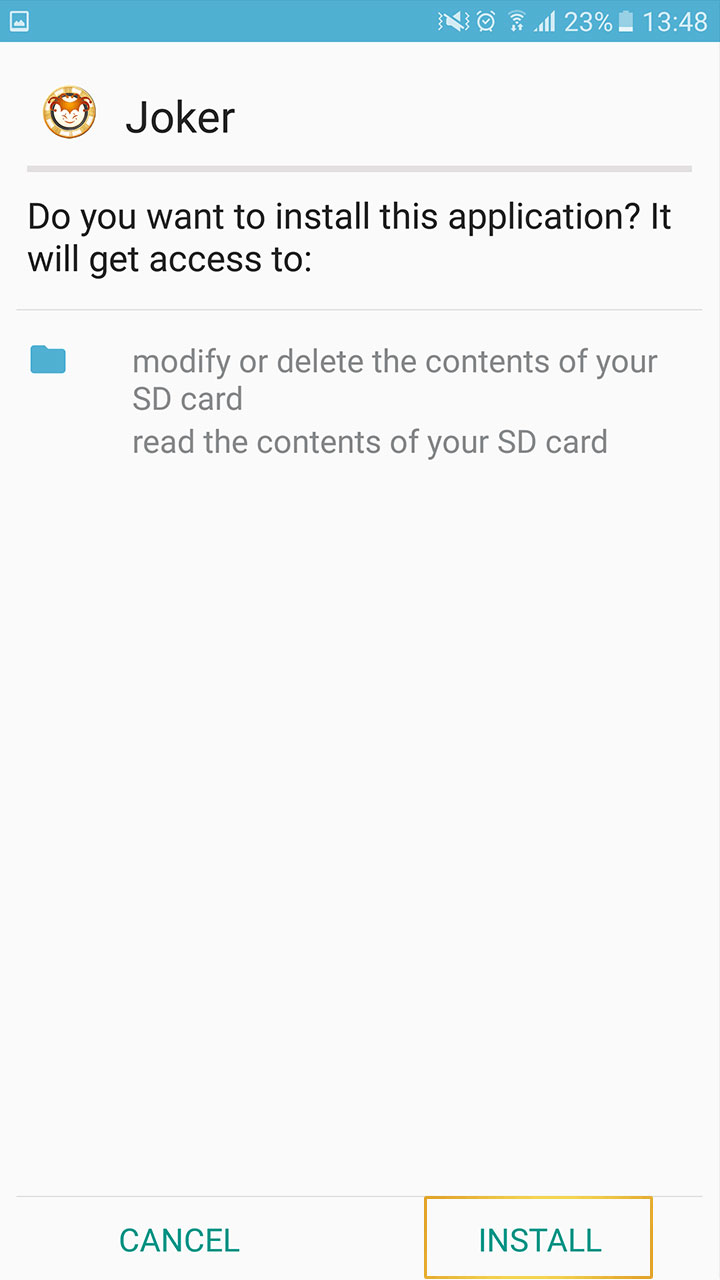

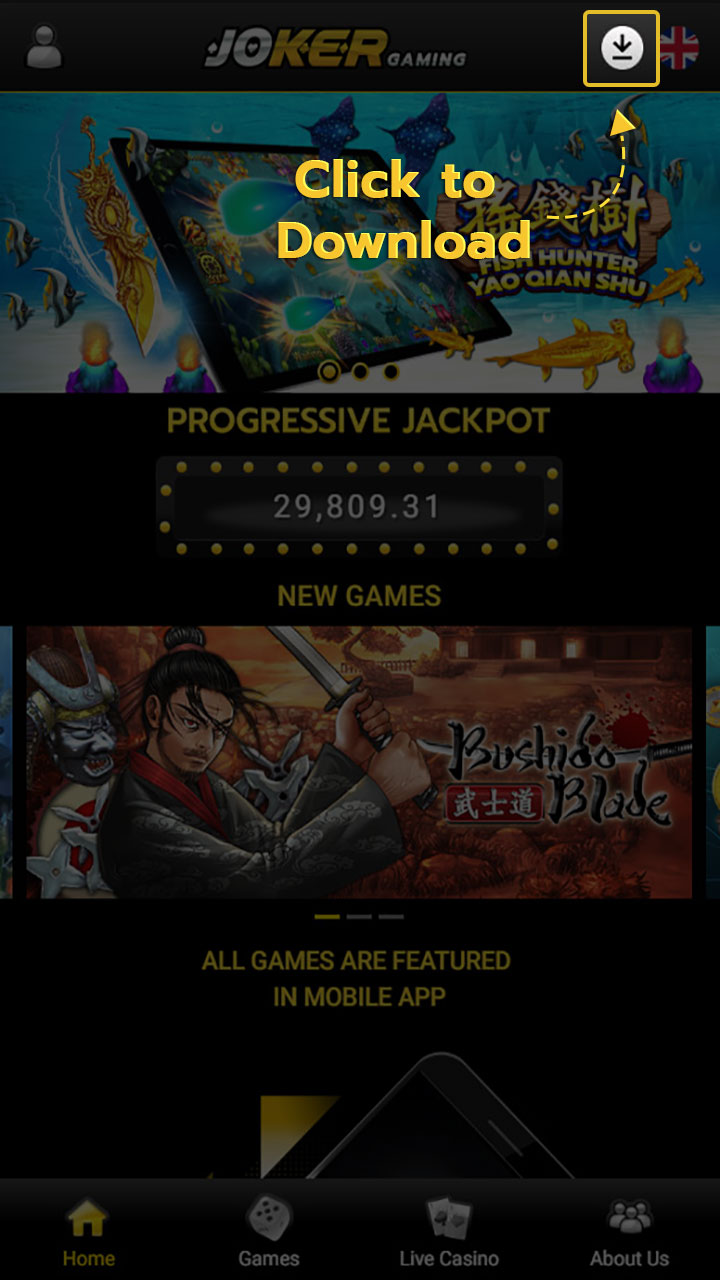

Instal Panduan - Android

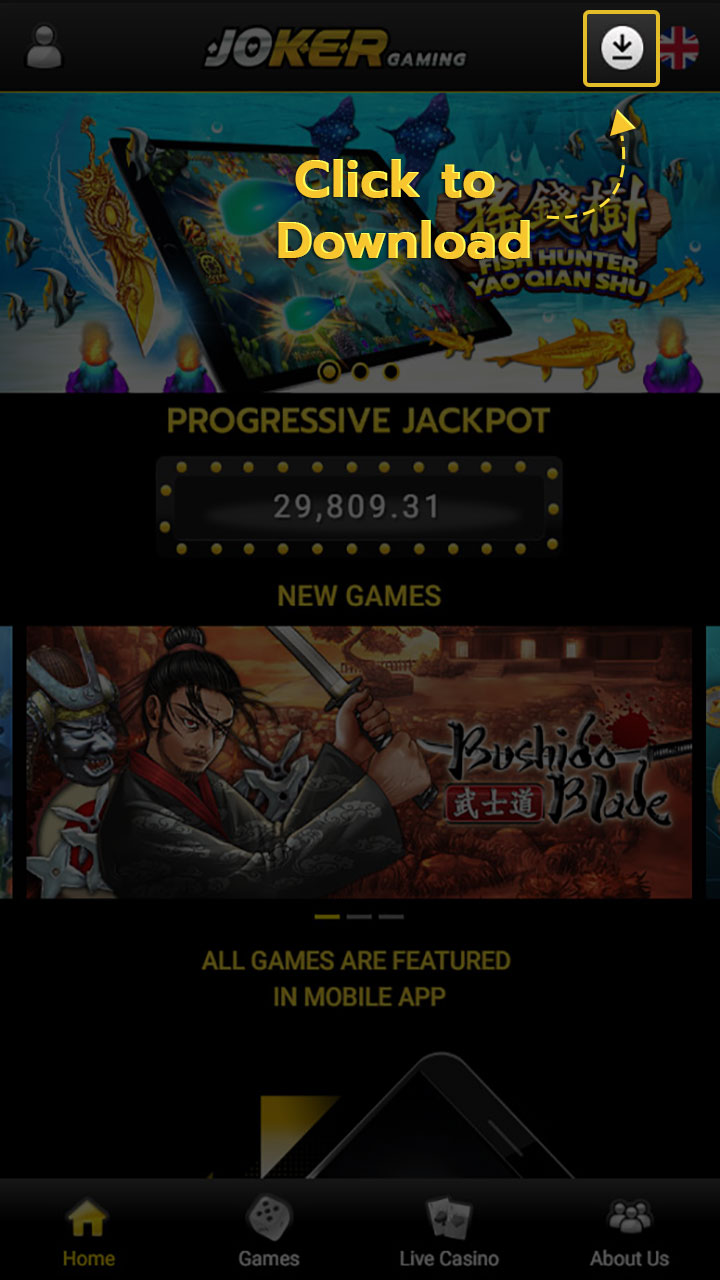

Langkah 1 :

Pindai Kode QR atau buka Situs seluler

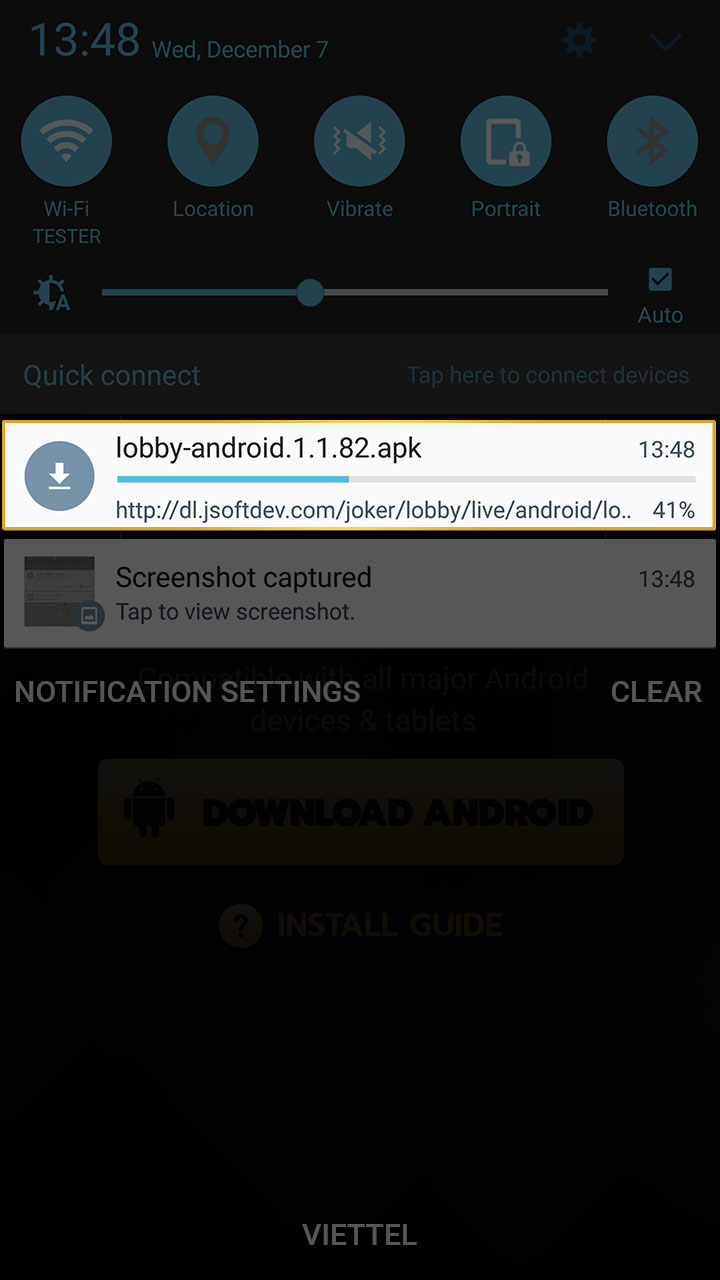

Langkah 2 :

Ikuti instruksi

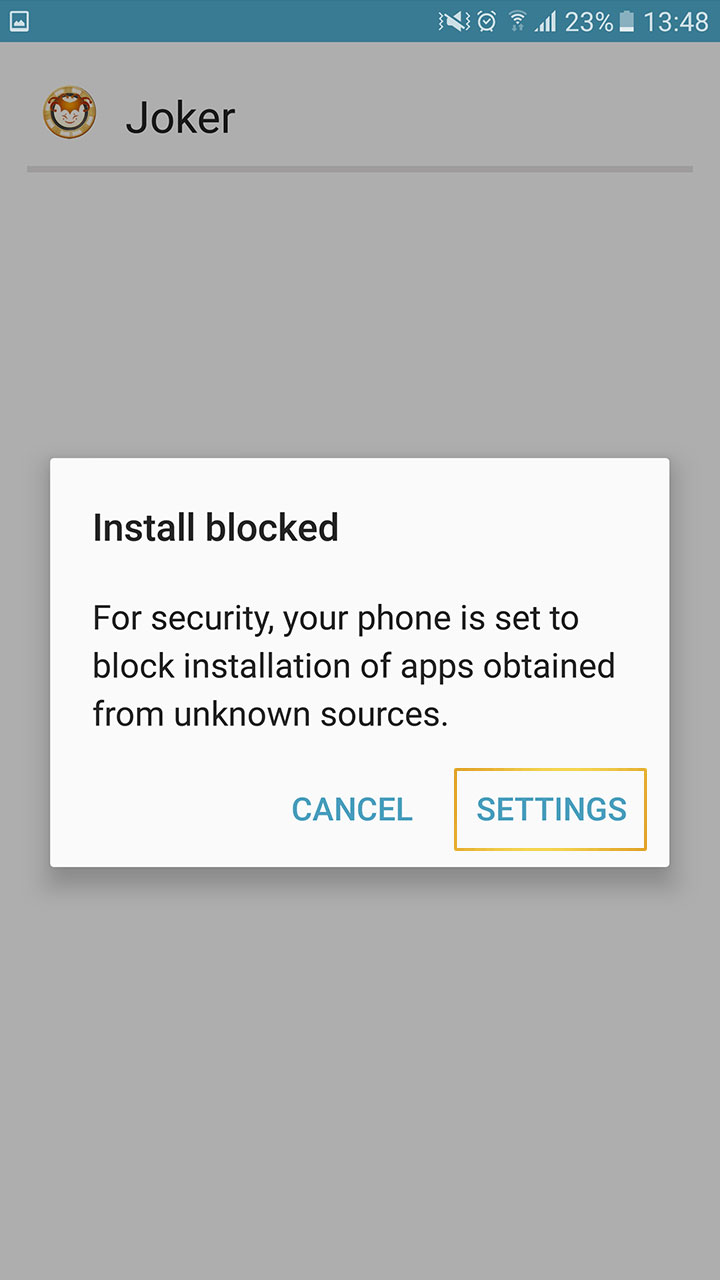

Langkah 2 (Terus) :

Ikuti instruksi

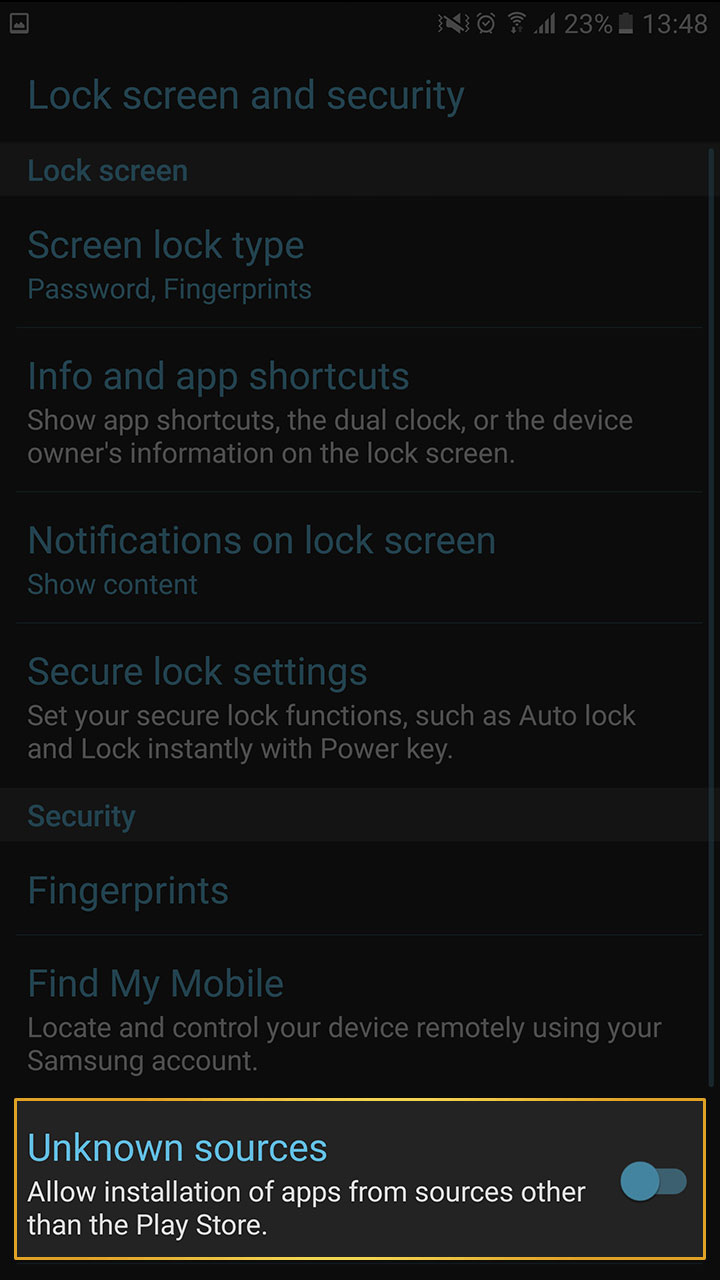

Langkah 3 (Terus) :

Ikuti instruksi

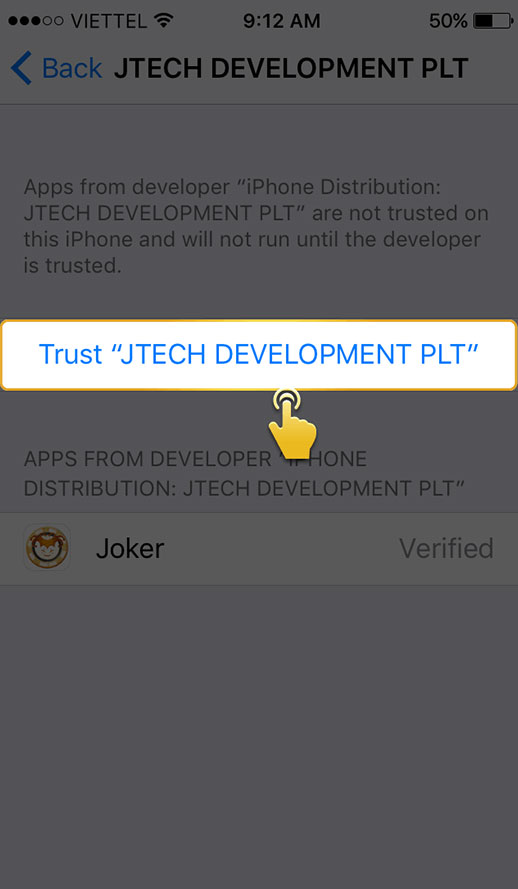

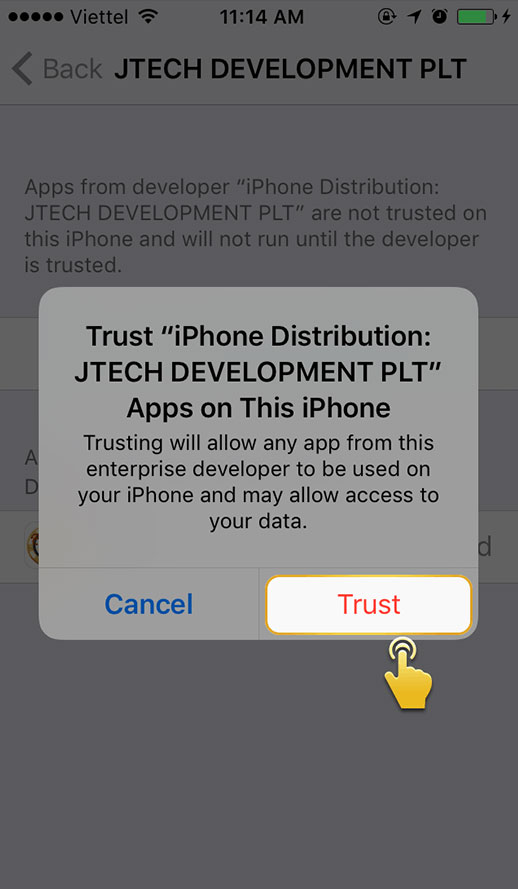

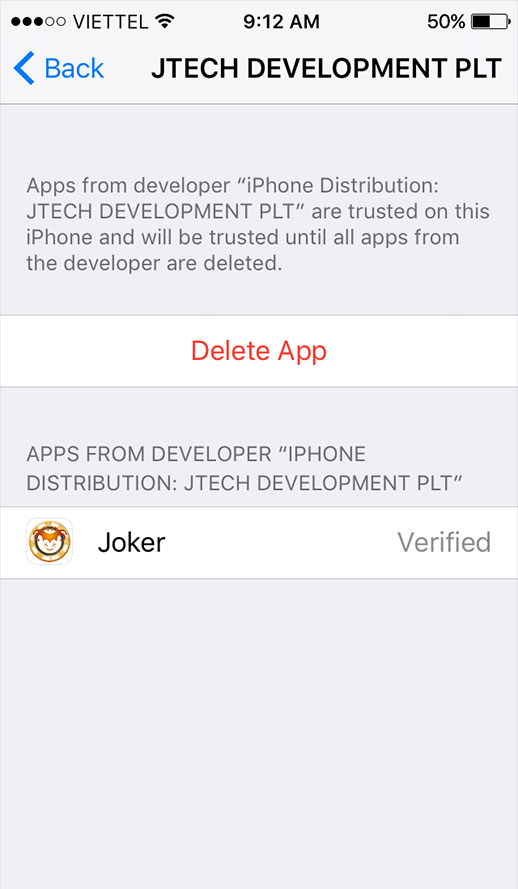

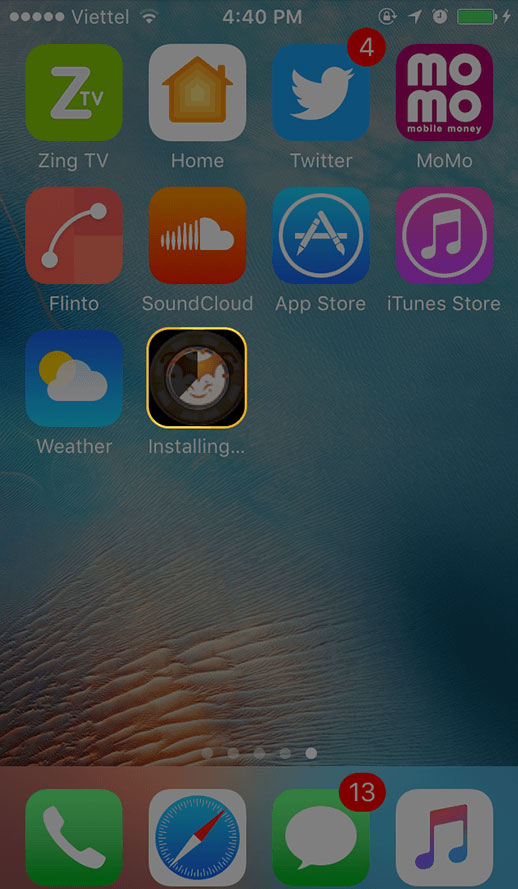

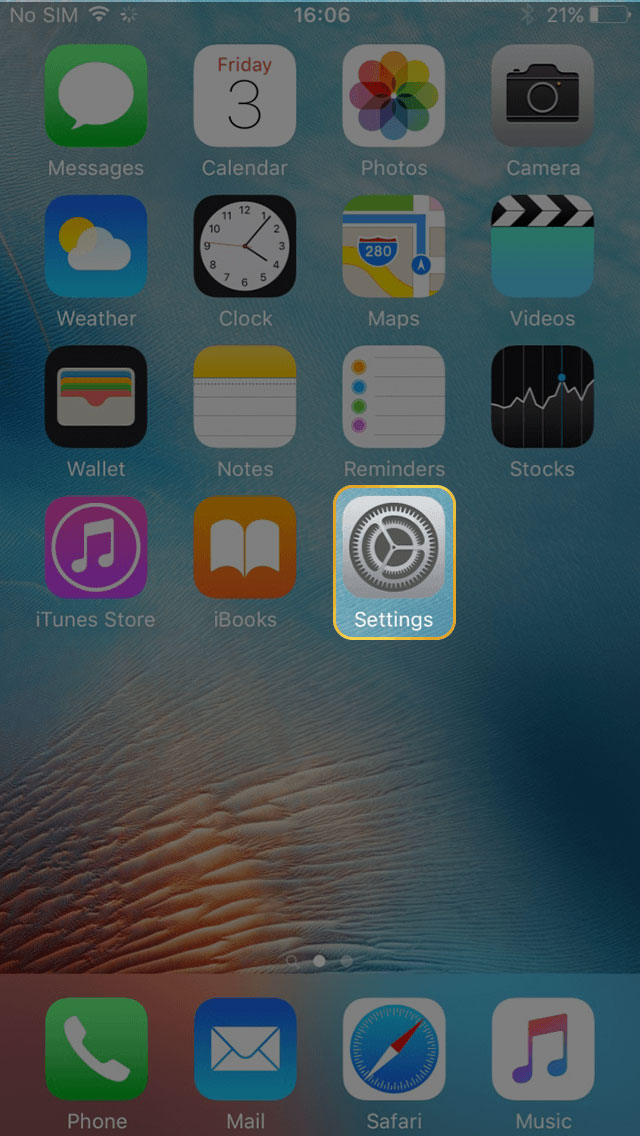

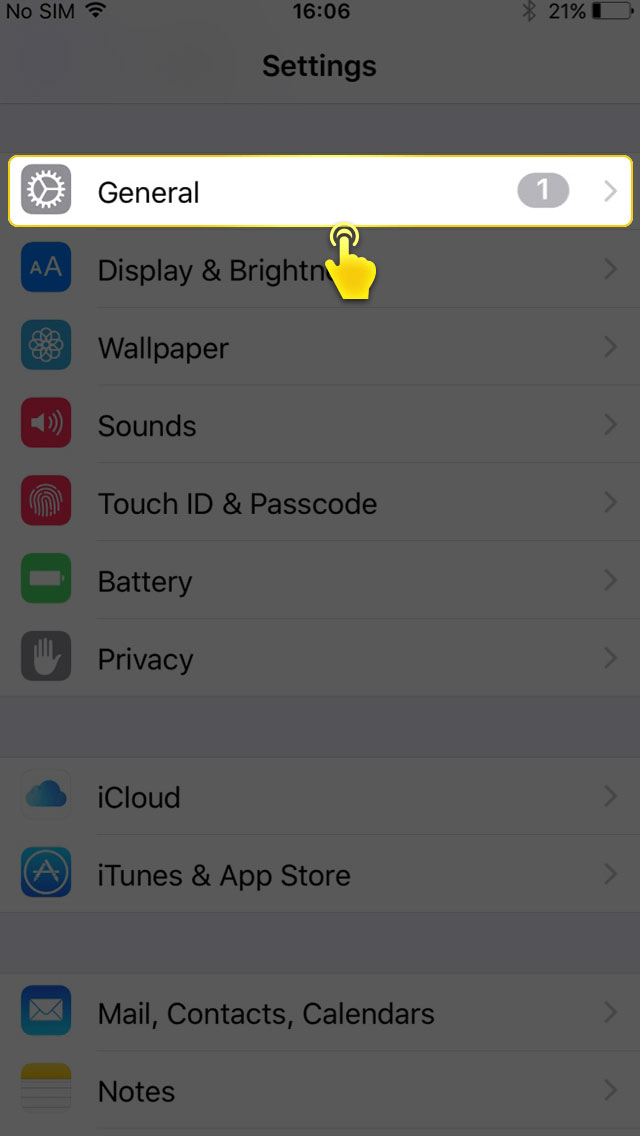

Instal Panduan - iOS

Langkah 1 :

Pindai Kode QR atau buka Situs seluler

Langkah 2 :

Ikuti instruksi

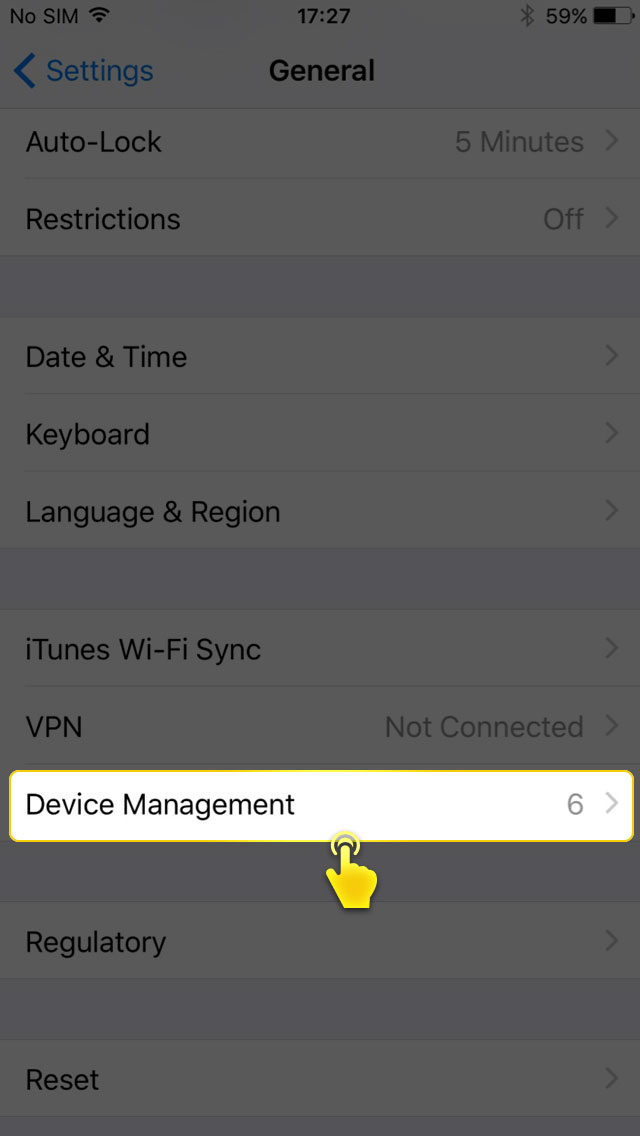

Langkah 2 (Terus) :

Ikuti instruksi

Langkah 2 (Terus) :

Ikuti instruksi